sales tax calculator reno nv

Nevada Internet Sales Tax Nolo New Rules on Collecting Sales Tax for Remote Sellers. Find your Nevada combined state and local tax rate.

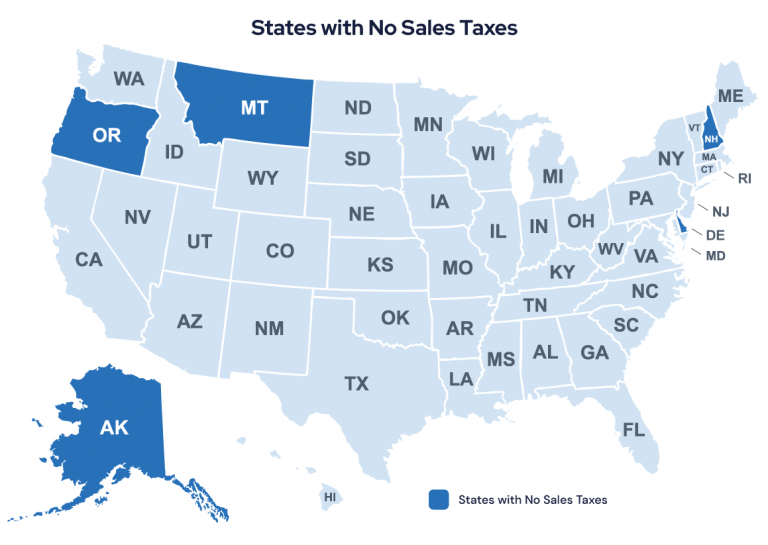

Sales Taxes In The United States Wikiwand

Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance.

. Nevada first adopted a general state sales tax in 1955 and since that time the rate has risen to. For tax rates in other cities see Nevada sales taxes by city and county. Many dealers remit sales tax payments with the title paperwork sent to the DMV Central.

Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Base state sales tax rate 46. 2022 Cost of Living Calculator for TaxesReno Nevada and Las Vegas Nevada.

Nevada state sales tax rate range. Spring Creek NV Sales Tax Rate. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price.

Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. Sparks NV Sales Tax Rate. Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3660615.

In the 2011 Legislative Session reduced the interest rate to 075 or 0075 from 1 or 01 effective 712011. The County sales tax rate is. Reno Nevada and Ventura California.

Nevada sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The correct tax rates will display based on the period end date selected. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Summerlin South NV Sales Tax. See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county.

Nevada collects a 81 state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a 149 dollar documentary fee. Nevada largely earns money from its sales tax which can be one of the highest in the nation and varies from 685 to 8375.

2300 cents per gallon of regular gasoline 2700 cents per gallon of diesel. Sparks Nevada and Reno Nevada. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000.

Sales Tax State Local Sales Tax on Food. Pahrump NV Sales Tax Rate. Total rate range 46-8265.

Reno Nevada and Las Vegas Nevada. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. This is the total of state county and city sales tax rates.

The base state sales tax rate in Nevada is 46. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize your own personal estimated. View 1547 homes for sale in Reno NV at a median listing price of 319900.

Real property tax on median home. Spanish Springs NV Sales Tax Rate. 3 beds 2 baths 1345 sq.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes. Spring Valley NV Sales Tax Rate. 1125 Forson Dr Reno NV 89509-2441 565000 MLS 220005277 This charming cottage is centrally located in Southwest Reno--walking distance to shoppi.

You can find these fees further down on. You can print a 8265 sales tax table here. Nevada State Tax Quick Facts.

Local rate range 0-3665. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable. Sales Tax Nevada Reno.

NV Sales Tax Rate. The December 2020 total local sales tax rate was also 8265. 31 rows North Las Vegas NV Sales Tax Rate.

Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. 2022 Cost of Living Calculator for Taxes. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. The minimum combined 2022 sales tax rate for Reno Nevada is. Paradise NV Sales Tax Rate.

The Reno sales tax rate is. Low property taxes and the absence of any state or local income taxes in Nevada can make it a particularly affordable place to own a home. See pricing and listing details of Reno real estate for sale.

The Nevada sales tax rate is currently. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. 053 average effective rate.

2022 Cost of Living Calculator for Taxes. The current total local sales tax rate in Reno NV is 8265. Get a quick rate range.

There is no applicable city tax or special tax. Reno NV Sales Tax Rate. In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees.

How To Become A Millionaire Brianowens Biz Book Worth Reading Books Reading

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Jesse Davies On Twitter Housing Market Real Estate Marketing Real Estate Tips

Nevada Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Nevada Vs California Taxes Explained Retirebetternow Com

Lv No Sales Tax Sema Data Co Op

Nevada Income Tax Calculator Smartasset

Sales Tax By State Non Taxable Items Taxjar

Lv No Sales Tax Sema Data Co Op

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

Lv No Sales Tax Sema Data Co Op

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings